Howie Liu had a decision to make. The recent Duke graduate had a job offer at Accenture, and his parents were excited for him to start his career at a big firm. However, something just didn’t feel right. As a consultant, Howie would be responding to client requests day in and day out, and he just couldn’t bring himself to sign up for a career that felt so uninspiring.

So Howie made a split-second decision that would later become the most important decision of his life: he never showed up for his first day of work.

Fast forward 12 years: Howie is the co-founder and CEO of Airtable. Valued at $7.7 billion, the company is best known for offering a low-code/no-code alternative to an often overlooked software tool: the spreadsheet.

In this article, we’ll be covering:

- Airtable’s founding story after Howie sold his first company to Salesforce

- How Airtable pivoted from a consumer to enterprise focus

- How a hybrid approach is serving Airtable’s full spectrum of customers

- The Airtable org chart and why it’s structured the way it is

The Early Years: How time and patience helped Howie start Airtable

Anyone familiar with Airtable’s story knows it was not Howie’s first rodeo in the start-up scene. After turning down the role at Accenture, Howie moved to San Francisco. While surviving on a ramen diet, he built Etacts, a CRM tool for personal relationships.

Then, things quickly kicked into high gear. Howie and his co-founder Evan Beard were accepted into Y Combinator, helping them reel in an impressive slate of early investors, including actor Ashton Kutcher. Ten weeks of furious coding later, Etacts officially launched. Within the year, Howie and Evan sold the company to Salesforce.

After a year at the tech giant, Howie took a well-deserved sabbatical to consider his next move. With the financial runway to think more deeply about what to build next, he spent the next year learning more about holistic product design and the culture of his next entrepreneurial enterprise.

The biggest thing the acquisition bought me was the luxury of time and patience. I wasn’t doggy-paddling anymore just to keep my head above water.

Howie Liu, Co-Founder & CEO

During his time off, Howie came up with the idea for Airtable. He envisioned a web-based solution that would help users distill complex data sets into an intuitive and usable spreadsheet-like interface. To bring this vision to life, Howie tapped friend and co-founder Andrew Ofstad. This time, however, the pair had the luxury of time. Instead of rushing to launch, the initial version of Airtable would not ship for two and half years.

Even today, Airtable users will admit they have a hard time describing the product to friends and co-workers. In fact, Howie encountered the same challenge when first pitching to investors. After all, the low-code/no-code movement was not yet mainstream in 2012.

But Howie recognized the value of offering a lightweight solution early on. To him, Airtable had immense potential to democratize app building for its users. It was also the perfect setup for its product-led growth strategy early on.

Airtable is not just a productivity tool, but an app platform. Salesforce, for instance, is one giant customizable app platform. The magic is that you can customize it to the nth degree.

Howie Liu, Co-Founder and CEO

Moving from consumer to enterprise, defying the single use case

Shopping lists. Scoreboards. Vacation schedules. At the beginning, Airtable built templates for consumer use cases. But then, the team spotted big spikes in new users at large companies, including Conde Nast, a publications giant. Airtable quickly shifted its focus to enterprise customers.

Today, most B2B companies target a specific industry. But Airtable took a horizontal approach instead. Zoelle Egner, an early joiner (Employee #11) who led its marketing team until earlier this year, described its target user base as more psychographic in nature. They called this segment “tinkerers” — people who love playing with new tools, solving problems, and being the heroes within their company. You know the type; you might be that type.

Even today, most customers are introduced to Airtable through a single use case. But the “aha moment” comes after realizing its capabilities are more like a toolkit. The biggest challenge is getting users to go from “I need to solve my specific issue” to “Wait, I can actually use this to solve any number of problems.”

At the very base, Airtable is a platform. But we also get to be hyperspecific with its value and use case applicability.

Howie Liu, Co-Founder and CEO

Over time, Airtable’s use cases have ballooned to over 3,000 and represent a broad range of users. I know what you’re thinking — that’s a lot! But part of what makes Airtable so great is that it can be adapted for any industry. This mass-market appeal also explains its early successes in product-led growth.

Airtable’s hybrid approach: growing beyond the tinkerer

Now, Airtable is growing up. These days, it’s targeting video producers at large production companies and supply chain managers at fashion retailers. As these enterprise customers have come to rely on Airtable for a broader variety of solutions, the company has expanded beyond a purely bottoms-up growth strategy.

As you’ll see below, Airtable now has an army of account executives as part of its sales function, supported by customer success. Together, the self-serve and enterprise sales teams work hand-in-hand, all in service of delivering value to the customer.

Get the latest insights and analysis on Product-Led Growth companies weekly

Self-serve

On one side is Lauryn Isford, who leads Airtable’s self-serve product and continues to take a bottoms-up approach to user growth. Having worked on similar teams at DropBox and Facebook early on in her career, Lauryn is a vocal proponent of PLG.

In her role, the goal is to fundamentally improve the onboarding experience. That way, users are empowered to progress through the product lifecycle with as little friction as possible. This stands in stark contrast to growth hacking, or using creative but low-cost tactics to attract and retain users. According to Lauryn, you can only write so many perfect email campaigns before the pay-offs cap out.

Enterprise

There’s a limit to how far the early adopters within a large company — those tinkerers we know and love — can evangelize the product. At a certain point, spreading Airtable to other teams within an organization requires a more hands-on approach.

For CRO Seth Shaw, Airtable is at a tipping point. Building beyond its legacy of PLG, it’s unlocking its next stage of growth by focusing more on the enterprise side of the business. To do this, Seth is equipping his sales function to drive wall-to-wall adoption and ultimately deliver value for enterprise customers.

Seth describes this hybrid approach as a natural evolution. “You have to transition from solving things on the ground for an individual user to solving problems that executives care about, that gets budgeting and focus within the organization, and that multiple groups can rally around.”

Bringing the two sides together

Airtable is not alone in this “natural evolution.” Slack, too, is going through a similar transition. Like the messaging platform, Airtable is hoping to maintain the best parts of a bottoms-up adoption model, while inserting a more traditional sales motion.

To do this, the sales team is working closely with its largest customers to understand their specific needs. Meanwhile, the product team is doubling down on developing functionalities around larger-scale B2B use cases.

Where does Howie fit into all of this? On his end, he’s working hard to foster a “one team” culture and remains open-minded to different growth tactics that marry the best of both worlds. “Culture isn’t just soft and fluffy and nebulous,” he insists. “It’s behaviors and motivations and incentives. It drives the outcomes you want.”

For more on Airtable’s growth, check out this thread from Ross Simmonds:

Insights from the Airtable org chart

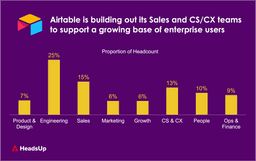

Notes: “Product & Design” includes Product, Design, and Research; “Engineering” includes Engineering and Data.

Takeaways:

Sales (15%)

- Dedicated Account Executives are supporting Airtable’s growing base of enterprise customers

- Business Development Representatives are categorized into Mid-Market and Enterprise customers and include an outbound sales motion

Growth (6%)

- Airtable’s Growth team is cross-functional in nature, with dedicated Account Executives, a small team of Software Engineers, and Data Science capabilities

CS & CX (13%)

- Over half of Airtable’s CS/CX team joined in 2021, representing a shift toward deeper customer engagement across all points of the customer lifecycle

- Select CS/CX representatives are responsible for supporting Airtable’s major accounts

Let’s dive a little deeper: the full Airtable org chart

- Airtable (696 total*) – Led by Co-Founders (3)

- Product (14 total) – Led by Chief Product Officer (1)

- Head of Product Strategy (1)

- Head of Platform Product (1)

- Head of Self Serve Product (1)

- Product Leads (3)

- Product Managers (7)

- Design (21 total) – Led by Head of Design (1)

- Animator (1)

- Art Director (1)

- Design Manager (2)

- Product Designer (11)

- Brand Designer (2)

- Interactive Designer (1)

- Graphic Designer (1)

- Web Designer (1)

- Research (11 total)

- Engineering (160 total) – Led by Chief Technology Officer (1)

- Head of Core Product Engineering (1)

- Head of Platform Engineering (1)

- Head of Quality Engineering (1)

- Security Engineers (3)

- Head of Sales Engineering (1)

- Sales Engineers (7)

- Customer Solutions Engineers (2)

- Integration Engineer (6)

- Head of Web Engineering, Marketing (1)

- Site Reliability Engineer (1)

- Engineering Managers (10)

- Software Engineers (102)

- Product Engineers (8)

- Solutions Engineers (2)

- Head of Business Technology (1)

- Infrastructure Engineers (6)

- Developer Support Engineers (2)

- Other (4)

- Data (16 total)

- Data Scientists (11)

- Data Engineers (3)

- Data Entry Specialists (2)

- Sales/Revenue (106 total) – Led by Chief Revenue Officer (1)

- Head of Sales Planning and Effectiveness (1)

- Sales Analyst (3)

- Head of Sales Strategy and Operations (1)

- Sales Operations (4)

- VP of Sales (1)

- Sales Managers (5)

- Account Executives (21)

- VP of Strategic Sales (1)

- Strategic Account Executives (7)

- New Business Account Executives (3)

- VP of Enterprise Sales (1)

- Director of Enterprise Sales (1)

- Enterprise Sales Managers (3)

- Enterprise Account Executives (13)

- Director of Sales Enablement (1)

- Sales Enablement (2)

- Sales Development Manager (1)

- Sales Development Representatives (10)

- Business Development Representatives (10)

- Other (16)

- Head of Sales Planning and Effectiveness (1)

- Marketing (45 total) – Led by Chief Marketing Office (1)

- VP of Marketing (1)

- VP of Product Marketing (1)

- Product Marketers (8)

- Head of Community (1)

- Education (3)

- Head Of Content (1)

- Content Marketing Strategists (2)

- Content Writers (4)

- Technical Writers (3)

- Copywriters (2)

- Head of End-User Marketing (1)

- Customer Marketers (1)

- Lifecycle Marketers (1)

- Head of Global Communications (1)

- Director of Communications (1)

- Director of Social Media (1)

- Director of Internal & Executive Communications (1)

- Head of Marketing Operations and Analytics (1)

- Senior Manager, Marketing Operations (1)

- Head of SEO (1)

- Performance Marketers (2)

- Marketing Intelligence Lead (2)

- Brand Creative Director (1)

- Associate Creative Director (1)

- Creative Project Manager (1)

- Integrated Campaigns (1)

- Growth (44 total)

- Director of Growth Sales (1)

- Growth Account Executives (22)

- Growth Engineers (4)

- Growth Data Science Manager (1)

- Head of GTM Strategic Initiatives (1)

- GTM Strategic Initiatives (4)

- Other GTM (3)

- Other Strategic Growth or Sales (8)

- Director of Growth Sales (1)

- CS & CX (87 total)

- Head of Customer Support (1)

- Head of Large Accounts (1)

- Head of Customer Education (1)

- Customer Programs Directors (2)

- Customer Education (1)

- Customer Support Managers (3)

- Enterprise Support (8)

- Customer Support (12)

- Customer Onboarding Manager (1)

- Onboarding Specialists (5)

- Customer Success Managers (44)

- Other (8)

- People (70 total) – Led by Chief People Officer (1)

- Head of Learning & Talent Development (1)

- Head of People Analytics (1)

- Head of People Technology (1)

- Head of Recruiting (1)

- Recruiting Manager (3)

- Sourcers (7)

- Recruiters (17)

- Recruiting Coordinators (9)

- Head of Technical Recruiting (1)

- Engineering Recruiting Manager (1)

- Technical Sourcers (8)

- Technical Recruiters (7)

- DE&I (5)

- Other (7)

- Finance (23 total) – Led by Chief Financial Officer (1)

- Accounting (6)

- Billing & Collections (2)

- Finance & Strategy (10)

- Controllership (2)

- Other (2)

- Operations (39 total)

- Head of Customer Strategy & Operations (1)

- Head of Customer Engagement Operations (1)

- Head of People Partnering & Operations (1)

- People Operations (2)

- Head of Productivity Strategy & Operations (1)

- Productivity Strategy & Operations (2)

- Head of Professional Services (1)

- Head of Strategic Operations (2)

- Program Manager, Strategic Operations (1)

- Head of Website Strategy & Experiences (1)

- Implementation Managers (2)

- Implementation Specialists (11)

- Support Operations Manager (1)

- Support Operations (3)

- Product Operations (1)

- Research Operations (1)

- Legal Operations (1)

- Recruiting Operations (1)

- Pricing & Monetization (1)

- Special Projects Lead (1)

- QA Analysts (2)

- Other (1)

*Deep dive list excludes Investors/Advisors, Legal, IT, and Admin roles, and is an outside-in aggregation of the org

If you liked this piece, you might want to check out our org chart deep dives of Notion and Retool, or our analysis of how go-to-market strategy evolves in other successful SaaS businesses.